Quick home loan callback - guaranteed

Ready to chat? Add your details below and one of our friendly Lending Specialists will be in touch to chat about your discount before you know it.

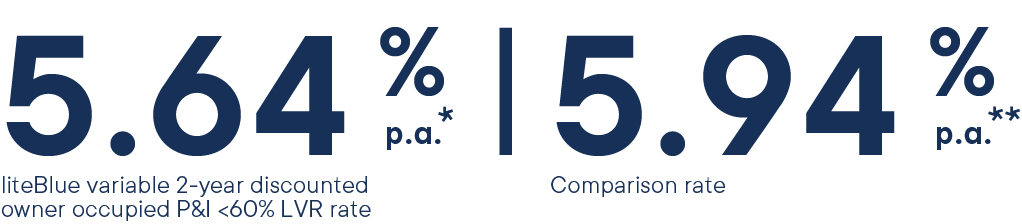

liteBlue Variable home loan 2-year discounted rate

5.64% p.a.*

liteBlue variable 2-year discounted owner occupied P&I <=60% LVR rate

5.94% p.a.**

comparison rate

- 0.35% discount for two-years

- Variable rate

- Locals only offer

- Available to current customers

- Available to owner occupiers and investors

- $199 application fee2

- No ongoing fees

- Free unlimited online redraw

- Additional repayments

- Top up available

- Split loan available

- Construction loan available

- 30 year maximum loan term

liteBlue Variable home loan standard rate

5.99% p.a.*

liteBlue variable rate owner occupied P&I <=60% LVR rate

6.00% p.a.**

comparison rate

- 0.35% discount for two-years

- Variable rate

- Locals only offer

- Available to current customers

- Available to owner occupiers and investors

- $199 application fee2

- No ongoing fees

- Free unlimited online redraw

- Additional repayments

- Top up available

- Split loan available

- Construction loan available

- 30 year maximum loan term

Get the low down on the liteBlue features

Our liteBlue Variable Rate home loan gets straight to the point, with our lowest rate and the simplest features. A match made in heaven.

Browse features

liteBlue Variable Rate home loan

$199 application fee 2

Construction loan available

Flexible repayments

Interest only repayments

Additional repayments

Unlimited free online redraw facility

$30 per manual redraw (e.g. in branch)

30 year maximum loan term

95% maximum loan-to-value-ratio (incl. LMI)

$300 switch fee 1

$300 top up fee

| liteBlue 2-year Variable Rate Owner Occupied Principal & Interest discount | Annual percentage rate | Comparison rate (p.a.) |

|---|---|---|

| <=60% LVR | 5.64%* | 5.94%** |

| 60.01% <=80% LVR | 5.74%* | 6.04%** |

| 80.01% <=90% LVR | 5.94%* | 6.24%** |

| 90.01% <=95% LVR | 6.34%* | 6.63%** |

| liteBlue 2-year Variable Rate Investor Principal & Interest discount | Annual percentage rate | Comparison rate (p.a.) |

|---|---|---|

| <=60% LVR | 5.79%* | 6.09%** |

| 60.01% <=80% LVR | 5.89%* | 6.19%** |

| 80.01% <=90% LVR | 6.09%* | 6.38%** |